[EMPIRE VAMPIRE Tattler]

Close Ranks Spiritually - Spread Out Tactically

~ Find the Enemie's Agents ~

bits of wisdom from:

Stepping through the Minefields:

notes from: Wisdom of the Armchair General

~ by cyber Tacticus

=

Central Bankers Fueling Global Commodity Inflation

posted on: February 15, 2008 |

Central bankers and finance ministers from the world's top-10

economic powers huddled behind closed doors in Tokyo

last weekend, trying to work out a joint strategy to rescue

Roughly $6-trillion was lost on global stock markets in the month

of January, triggered by the biggest financial crisis

since the Great Depression, and a US housing slide,

that could topple the giant US economy into recession.

Central bankers from the United States, Japan, Germany,

France, Canada, Britain, Italy, China, South Korea, and Russia,

collectively control the money spigots in three-quarters

of the world's $65 trillion economy.

"We are not yet at the end of the market crisis,"

warned Euro-group finance chief Jean-Claude Juncker.

"The corrections will drag on for a few weeks, or months.

We have agreed in Tokyo that if there are irrational price

movements in the markets, we will collectively take suitable

measures to calm the financial markets," he said.

Asked what type of collective action the G-7 might take

during another stock market meltdown, Juncker said,

"Whoever has a strategy should not lay it out.

Otherwise it will lose its effect, if it is explained."

Russian Finance Minister Alexei Kudrin hinted at a coordinated

round of G-7 rate cuts. "Coordination of efforts between

central banks on their refinancing rates may soften

the consequences of the global credit crisis, because this is

the key factor supporting financial systems," he explained.

Other weapons in the G-7's arsenal to counter a bear market

for equities include brainwashing investors through the media,

fudging economic and inflation data, inflating the money supply,

managing the "yen carry" trade, and outright intervention

in stock index futures, championed

by the US "Plunge Protection Team."

After surveying the global landscape, the G-7 warned,

"Downside risks still persist, including further deterioration of the

US residential housing markets and tighter credit conditions."

Bank of Italy chief Mario Draghi added,

"Risks are further shocks may lead to a prolonged recurrence

of the acute liquidity pressures experienced last year.

We face a prolonged adjustment, which could be difficult," he warned.

Banks and brokerage firms around the world face

$400 billion in write-offs of toxic sub-prime US mortgages,

said German Finance Minister Peer Steinbrueck on Feb 11th.

"The crisis that spread from the US property market to

global financial markets may continue well into 2008,"

he warned. The US credit crisis is no longer just a sub-prime

mortgage problem. Many prime loans made in recent years

also allowed borrowers to pay less initially,

but with higher adjustable payments in later years.

With US home prices falling and lenders clamping down,

homeowners with solid credit are also under the same

financial stress as those with sub-prime credit.

Over 40% of all mortgages issued from late 2005 to early 2007

are based on adjustable rates, so about $45 billion

would reset each month this year. The expected tax rebates

from Washington will cover less than two months of home payments.

Wall Street fueled the growth of sub-prime lending by packaging

$1.8 trillion of risky home loans into bundled securities,

and then marketing them as high-grade investments.

But with US mortgage foreclosures set to top 1 million this year

and home prices falling at the fastest pace since

the Great Depression, the same Wall Street investment banks

who profited by putting buyers into properties they couldn't afford,

are begging central banks and governments to manage the bust.

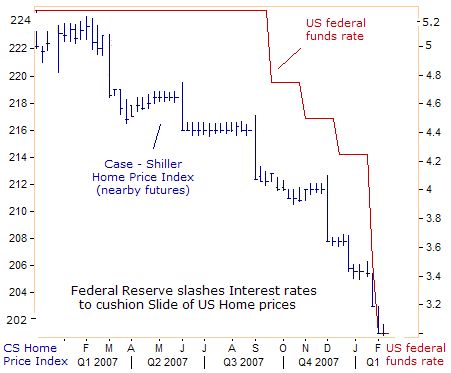

In Chicago, futures contracts for the Case-Shiller Home Price Index

in the 20-biggest US cities are 9.4% lower from a year ago,

and the slide might get worse as $550 billion of sub-prime

adjustable rate mortgages adjust upwards this year.

The Fed's rate cutting spree since September, slashing

the fed funds rate by 2.25%, might help by reducing

the reset rate for many adjustable-rate loans.

But US consumers are hobbled by falling stock prices, tighter

credit conditions, high gasoline prices, and a soft labor market.

Sliding home values are also eroding the equity US households

can tap for cash at the same time banks are tightening credit,

threatening the consumer spending that the economy needs

to dodge recession. "Going forward, we will continue to watch

developments closely and take appropriate actions,

individually and collectively, in order to secure stability

and growth in our economies," the G-7 said after their secret meeting.

The big threat to US household spending is primarily focused

on the slumping housing market, but a double-barreled assault

can be disastrous, so if the US stock markets keeps sliding,

it would probably tip the economy into recession.

And a US recession could undermine the global economy,

like tumbling dominoes, since the US consumer buys

about 20% of the world's $14.5 trillion of exports.

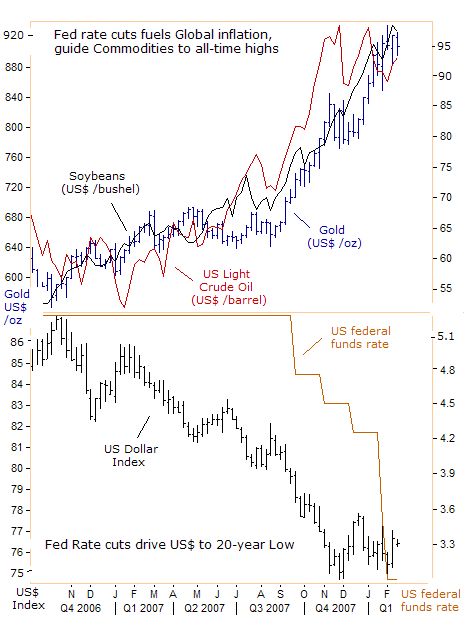

The Federal Reserve has been the most hyper-active G-10

central bank in pumping liquidity into the global markets, slashing

the fed funds rate to a negative 1%, in inflation adjusted terms.

The Fed "will be carefully evaluating incoming information bearing

on the economic outlook and will act in a timely manner

as needed to support growth and to provide adequate insurance

against downside risks," Fed chief Ben "B-52" Bernanke

told the Senate Banking Committee on Feb 14th.

The G-10 central banks will tolerate an upward creep in global

inflation, because the pain required to kick the money printing habit

is deemed too high. "Downside risks to the US economy

are the most important factor for Federal Reserve interest rate policy

for the time being," said Chicago Fed chief Charles Evans on Feb 14th.

"The Fed's focus needs to be on those risks, even though inflation

has been running a bit higher than we would like," he said.

G-10 central bankers are ignoring the deleterious side-effects

of their super-easy money policies.

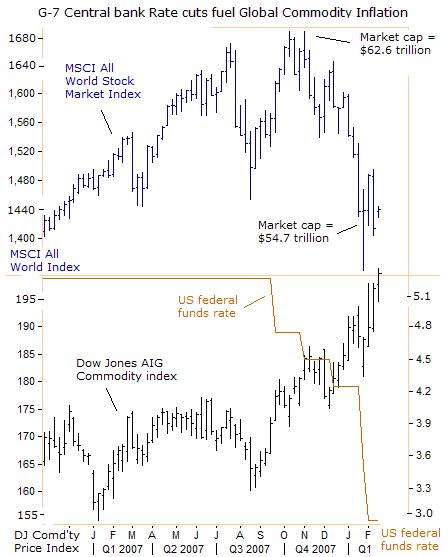

The Fed and G-7 central bankers have injected hundreds

of billions of dollars into the global money markets, fueling the

"Commodity Super Cycle," and intensifying global inflation.

Central bankers in Canada and the UK

have joined the Fed's rate cutting spree.

But the big surprise for G-7 central bankers might be how high

commodities can fly, even in the face of a global economic slowdown.

Since the Fed began lowering rates in August, the Dow Jones

AIG Commodity Index has jumped +22% to a record high

of 200-points, while the MSCI All World Index, measuring

the top-43 stock markets, has tumbled 7-percent.

Commodities have historically been regarded as wildly volatile

and risky, but since 2006, crude oil, gold, copper, silver,

platinum, cocoa, and grains have soared, hitting record highs,

and have trounced returns in the mis-managed G-7 stock markets.

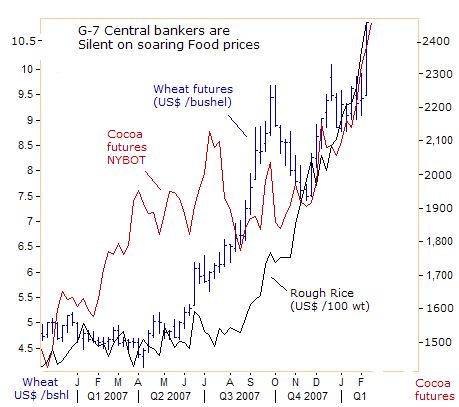

A remarkable run-up in prices of wheat, corn, oilseeds, rice,

and dairy products, along with sharply higher energy prices,

have been blamed on supply shortfalls, strong demand

for bio-fuels, and an inflow of $150 billion from investment funds.

From a year ago, Chicago wheat futures have soared

+120%, corn +20%, and soybeans are +80% higher.

Rough rice is up 55%, and platinum touched $2,000 /oz,

up 80% from a year ago, while US cocoa futures hit a 24-year high.

In agricultural commodities, there are supply constraints in terms

of the amount of arable land available. There are huge shifts

in demand from the emerging economies, where populations

are moving to cities, and incomes are rising, and changing

dietary patterns. Entering energy into the food equation,

the surging ethanol industry has put a squeeze

on the corn market, causing prices to be demand driven.

Bio-diesel traders are looking at soybean and vegetable oils.

Fund managers are pouring money into commodities

across the board as a hedge against the explosive growth

of the world's money supply, and competitive currency

devaluations engineered by central banks. Wheat had climbed

nearly 10% since the beginning of the year, hitting an all-time high

of $11.50 /bushel, as investment funds kept buying futures

with US wheat supplies at the lowest level in 60-years.

Because most global commodities are traded in US dollars,

the Federal Reserve has a special role to play in defending

the value of the US dollar in the foreign exchange markets.

On Dec 27th, Hu Xiaolian, director of China's Foreign Exchange

wrote, "If the US federal funds rate continues to fall,

this will certainly have a harmful effect on the US dollar

exchange rate and the international currency system,"

Hu wrote.

Central banks are flooding the markets with paper, and nobody

takes the dollar, the Euro, the yen, or the pound seriously.

Investors are turning to gold because it is the only true store of value.

The Arab oil kingdoms and Asian exporting nations

are importing inflation through their currency pegs and dirty floats,

but their patience with the US dollar is near the snapping point.

OPEC may abandon the US dollar for pricing oil and adopt the Euro,

said OPEC Secretary-General Abdullah al-Badri on Feb 8th.

"Maybe we can price the oil in the Euro.

It can be done, but it will take time.

It took two world wars and more than 50 years for the dollar

to become the dominant currency.

Now we are seeing another strong currency coming into the frame,

which is the Euro," said Badri.

The US Treasury and the Fed are risking a disastrous replay

of the 1970's, when high oil prices fueled double-digit inflation.

Every time the Fed lowered rates to boost job growth,

inflation took off, causing a vicious price spiral.

The Fed let inflation rage for so long that it took a strict

monetarist approach, adopted by Paul Volcker

in 1979 to finally defeat inflation.

However, the cost of subduing the inflation monster

was a deep recession, with unemployment hitting 11% in 1982.

Excessive monetary accommodation just takes the economy

from bubble to bubble to bubble. This time around,

the Fed's devaluation of the dollar, based upon Mr Greenspan's

2001-02 blueprints, has unleashed the biggest wave

of commodity inflation seen since the 1970's.

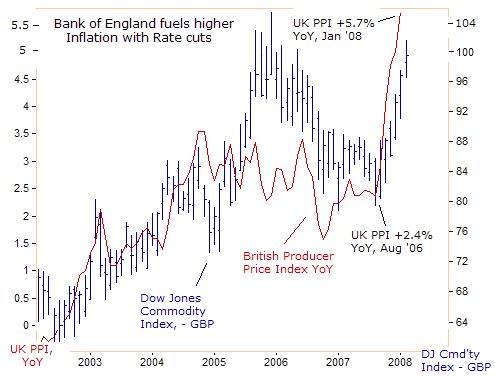

Bank of England follows in Fed's Footsteps

With 1.5 million adjustable rate mortgages due to reset

in the UK this year, the Bank of England has joined the Fed's

money printing orgy. On Feb 7th, the BoE lowered

its key lending rate by a quarter-point to 5.25%,

following a similar cut in December.

Pressure has increased on the BoE's Monetary Policy Committee

to slash borrowing costs, even as soaring energy and food bills

are driving inflation higher.

Britain's factories are facing the strongest input price pressures

on record and are ramping up prices to compensate,

but that didn't stop the Bank of England from lowering

its base rate to 5.25% last week, to shore up the

Footsie-100 stock index. And there is little sign that UK

price pressures are set to ease with the cost of raw materials

surging 18.9% from a year earlier, the fastest rate in 22-years.

UK producer prices are surging at an annualized 5.7% rate

in January, a 16-year high, not surprising, given the bullish trends

in the global commodity markets. The price of imported food

into the United Kingdom rose by nearly 15% in the past 12-months.

But the bigger fear haunting the BoE is that weaker growth

will undermine housing and stock prices, putting further pressure

on bank balance sheets, and prompting

a further tightening in credit conditions.

On Feb 13th, the BoE projected an economic slowdown to zero

percent in the first two quarters of 2008, with a high probability

that the UK economy will contract in at least one quarter.

BoE chief Mervyn King's message was blunt.

"Tighter credit conditions will bear down on demand, while

rising energy, food and import prices will push up on inflation.

Both developments are now more acute than in November,"

he warned.

Mr. King says the BoE is powerless to counter surging commodity

prices, which he believes "will result in a genuine reduction

in our standard of living. However, there is no point in us going mad

and pretending it is sensible to double interest rates

in order to bring inflation back to target in the next six months,"

he argued.

Instead, King thinks that slower growth over the coming year will

"reduce pressures on capacity" and bring inflation

down to target towards the beginning of 2009.

"The Bank of England needs to stop worrying about inflation

and cut interest rates to prevent a sharp slowdown in growth,"

said BoE policymaker David Blanchflower on January 27th.

"It's essential that the BoE get ahead of the curve,

as the current level of UK interest rates are restrictive.

Evidence from the housing and the commercial property market

is worrying. It is time for the MPC to lead not follow.

Worrying about inflation at this time seems like fiddling

when Rome burns," he declared

Herein is the crux of the "Stagflation" trap.

Lowering interest rates to bolster the local economy can backfire

by igniting faster inflation, and erode the purchasing power

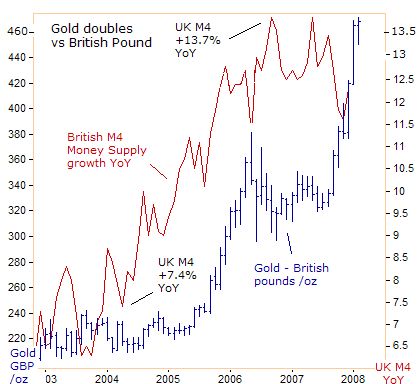

of local citizens. But the BoE has been destroying

the purchasing power of UK citizens for years,

by inflating the British M4 money supply, up 12.4% from a year ago.

Gold has risen by 110% against the British pound from four years ago,

and is a proven vehicle for protecting asset wealth

from abusive central bankers.

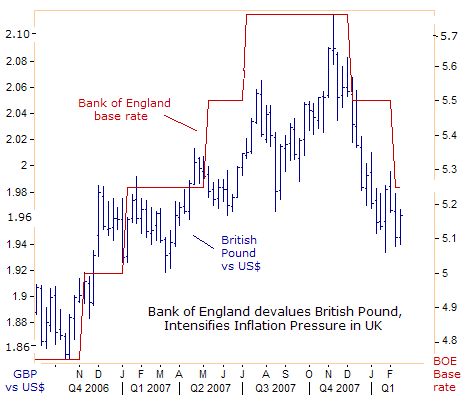

To ease the plight of its exporters, the BoE engineered

a 10% devaluation of the British pound, from a 26-year high

against the dollar in November. Britain's goods trade deficit

with the rest of the world ballooned to a record at 87.4

billion pounds ($170.4 billion) last year, up 10% from 2006.

The UK's current-account deficit widened to 5.7% of gross

domestic product, the highest of G-7 nations. But a weaker pound

also exacerbates Britain's inflation problem, by lifting import prices.

"The BoE needs to balance the risk that a sharp slowing

in activity pulls inflation below target against the

risk expectations keep inflation above target," the BoE said.

Given the choice of defending the purchasing power

of the British pound or rescuing the housing and stock market,

the BoE will eventually show its weak hand, and lower its interest

rates further, spinning its citizens on the treadmill of inflation.

=

Don't WASTE Your VOTE,

with Rockefeller's CFR Fake Candidates

The Real Hope is a

- Massive WRITE IN Campaign.

so STOP the CFR! Write in

Ron Paul / Keith Olberman

-

Ron Paul: Going the Distance - his Fireside Chat

=

Hillary clinton's admiration of a world government.

One World Government? - NETWORK 76 (Movie clip)

=

President Bush Is A Liar And A Fascist

=

police brutality - go skateboarding day: cop vs skaters

Baltimore cops V.S. skateboarder

END

=

A Quick Way to End the Iraq War (part 1 of 5)

=

The Secret Rulers of the World -

Present / Past - in 29 Parts

=

You Tube Search Results for "Ring of Power"

=

This is What A Police State Looks Like

Description: This is a breakdown of what happened

in Seattle when the Police attacked the crowd

with chemical weapons without provocation or reason.

They use video footage from the Police cameras themselves

to demonstrate the point that the Police indeed incite riots

and ATTACK crowds for no reason.

=

Cameras Turn Lens on Police Activities

=

Miami Police Shot Protester, then laugh about it.

=

BLACKWATER's Wet DREAM

http://dsc.discovery.com/tv/future-weapons/future-weapons.html?dcitc=w99-502-ah-1015?w99-502-ah-1015

Future weapons - EMP

Future Weapons: The Cougar APV & CROWS (1 of 2)

Future Weapons: AA-12 Combat Shotgun

& Grizzley APC (2 of 2)

=

Big Brother Is Reading Your Email

Big Brother Is Watching Everything 1-3 (BBC)

=

War with RUSSIA NEXT! -

Webster Tarpley on the Danger of OBAMA - (MP3 :- 2 )

with BREZINSKI as his controller

Listen to his INFORMED LOGIC - SCARY !!!

Vote your favorite, - but Put your MONEY on Obama

Vote your favorite, - but Put your MONEY on Obama

=

Perfected: The Ann Coulter Song

I Want to HATE like Ann Coulter.

(watch for Adam's Apple)

(Great slide at 1:40)

=

Israel's Dark History revealed. Traces of Poison

Israel, not Iraq, holds that distinction of being the first country

in the region to use weapons of mass destruction with genocidal intent.

Salman Abu-Sitta digs into a dark history

-

Zionism vs Judaism

An honest, sensative portrayal of Betrayel

-

| Zionist Kindergarten |

DENY THIS ! - You P.of S%&* Zionists !!!

=================================

KPMG set up "Son of BOSS" Tax Shelters

to Launder Kickbacks of Blood & Hush Money

to officials in U.S. Senate, U.S. Department of Justice,

New York Stock Exchange, Securities & Exch. Commission,

U.S. Army and the American Red Cross.

Most Recent Show

=

David Icke - Was He Right?

=

Confusion Say:

Only Fools Learn their Reality

Drinking from a Fountain of Illusion.

~ cyber Kung Fu Tse

=======

Never miss a thing. Make Yahoo your homepage.

To subscribe to the group

LEBANONVIEW-subscribe@yahoogroups.com

To unsubscribe from this group

LEBANONVIEW-unsubscribe@yahoogroups.com

~To visit the group site~

http://groups.yahoo.com/group/LEBANONVIEW/

LEBANONVIEW-subscribe@yahoogroups.com

To unsubscribe from this group

LEBANONVIEW-unsubscribe@yahoogroups.com

~To visit the group site~

http://groups.yahoo.com/group/LEBANONVIEW/

Change settings via the Web (Yahoo! ID required)

Change settings via email: Switch delivery to Daily Digest | Switch format to Traditional

Visit Your Group | Yahoo! Groups Terms of Use | Unsubscribe

.

__,_._,___

Tidak ada komentar:

Posting Komentar